Check Out The Latest Financing Programs From Patriot Capital!

Exclusive Gasboy Prime Program

Get great rates and low payments!

Now through September 30, 2022, Patriot Capital is offering an exclusive financing program for Gasboy Islander Prime and Atlas Prime equipment.

Benefits of financing with Patriot Capital include:

- 100% Project Financing

- Deferred Payment Plan

- Fixed Payments, Competitive Rates

- Upgrade Multiple Sites At Once

All packages include EKOS and the fuel site module. Click here to see brochure for details and feel free to contact us today at 1.800.451.4021 or email us for more details.

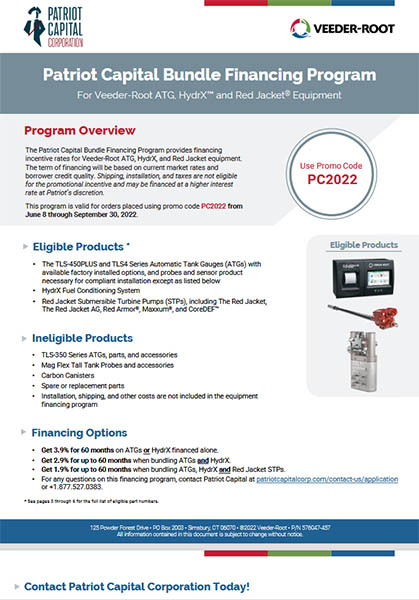

Bundle Financing Program

Use Promo Code

PC2022

Now through September 30, 2022, Patriot Capital is offering a bundle financing program for select Veeder Root ATG, HydrX and Red Jacket equipment.

- Eligible Products

-

- The TLS-450PLUS and TLS4 Series Automatic Tank Gauges (ATGs) with available factory installed options, and probes and sensor product necessary for compliant installation except as listed below

- HydrX Fuel Conditioning System

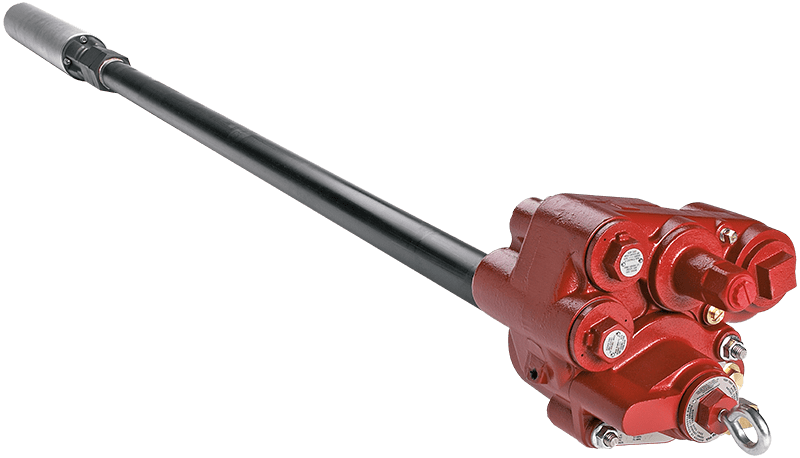

- Red Jacket Submersible Turbine Pumps (STPs), including The Red Jacket, The Red Jacket AG, Red Armor®, Maxxum®, and CoreDEF™

- Ineligible Products

- TLS-350 Series ATGs, parts, and accessories

- Mag Flex Tall Tank Probes and accessories

- Carbon Canisters

- Spare or replacement parts

- Installation, shipping, and other costs are not included in the equipment financing program

- Financing Options

-

- Get 3.9% for 60 months on ATGs or HydrX financed alone.

- Get 2.9% for up to 60 months when bundling ATGs and HydrX.

- Get 1.9% for up to 60 months when bundling ATGs, HydrX and Red Jacket STPs.

- For any questions on this financing program, contact us at 1.800.451.4021 or email us

Click here to see pages 3 – 6 of the program brochure for eligible part numbers.

Click on the logos below to find their products in our web store:

|

|

|

And remember, if you can’t find what you are looking for, please feel free to contact us at 1.800.451.4021 or Email Us!!

_SM_0.png?width=440&name=Express-Lane-(Right-Face)_SM_0.png)

The number and size of the HBIIP grants will depend on the successful number of applicants. The agency expects to give out about 150 awards, providing assistance to 1,500 locations.

The number and size of the HBIIP grants will depend on the successful number of applicants. The agency expects to give out about 150 awards, providing assistance to 1,500 locations.

If you are considering upgrading your site, there’s never been a better time. Lock in today’s low interest rates through December 2022 when you

If you are considering upgrading your site, there’s never been a better time. Lock in today’s low interest rates through December 2022 when you  finance your new gas pumps, point of sale, underground storage tanks or other fueling or in-store equipment.

finance your new gas pumps, point of sale, underground storage tanks or other fueling or in-store equipment. Order by November 30, 2017. Equipment installed by December 31, 2017 is eligible for Section 179 tax savings in 2017.

Order by November 30, 2017. Equipment installed by December 31, 2017 is eligible for Section 179 tax savings in 2017.